Quite often I am asked to consult with a company on their social media listening strategy. Their initial question more times than not is about the listening platform they should use. But it is increasingly common for the questions to be more sophisticated and the ambition behind them to be much greater. Companies with experience in social listening know that it is all too easy to focus on rudimentary analysis of brand mentions and topics, Followers and Likes and never get to the truly actionable insights that lead to marketing or business actions. Experience in listening is an important element here but you also need a path to follow. I thought a maturity model approach to social media listening could provide a possible path to consider and would provide a construct that could be used in consulting with a company on their social listening strategy.

Maturity models are sort of hot – there seems to be a proliferation in the last two years or so. One that I find particularly insightful and helpful when thinking about social listening is Forrester’s Social Maturity Model. Two really important points the folks at Forrester make is that listening is not the goal, social intelligence is, and that social intelligence informs actions taken by marketing or some other area of the business. Action being the operative word here. Social intelligence is a closely related topic to social business, and if social business is more your thing the Dachis Group has an interesting social business maturity model. Big data more your bag? Check out IBM’s big data governance model. After looking at the models out there, I could not find one specific enough to social media listening so I took a stab at creating one.

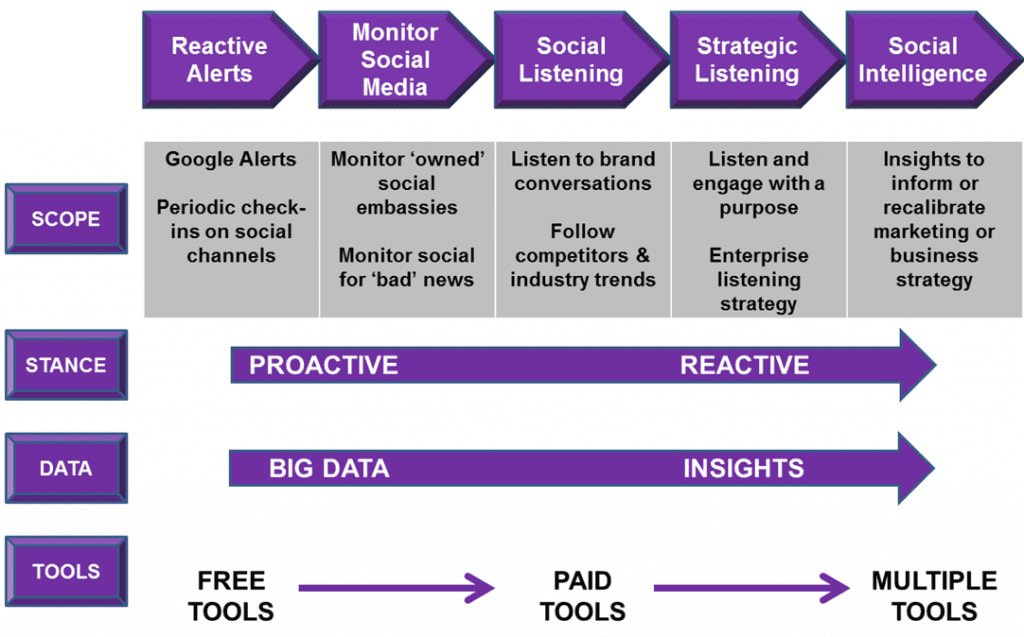

There are five stages in the Social Media Listening Maturity Model, beginning with reactive alerts and ending with social intelligence. Let’s take a brief look at each stage and some of the overarching differences or changes one sees with social listening maturity.

Reactive Alerts – Many companies or brands begin by establishing a reactive alert system that notifies them whenever their brand is mentioned or is mentioned with specific keywords. Think Google Alerts. Companies in this stage may only periodically check social media channels to see what may have changed or is new since the last check-in.

Monitoring Social Media – At the next stage, the company has begun active monitoring of all ‘owned’ social embassies. They also are monitoring social media conversations, often focused on trying to detect any ‘bad’ news, mentions or conversations.

Companies in these first two stages generally have a reactive stance toward social media, viewing it as another way to find out about news and circumstances that may harm or otherwise impact the organization. It is common for companies in these stages to use one or more of the various free tools available to gather web and social media data.

Social Listening – The third stage is most likely where the largest percentage of companies reside today. Companies in stage three are listening to social conversations about their company, brands and products. They are tracking mentions of competitors and calculating share of conversation. Many also track issues and topics that are important to their brands/products/company. At this stage many begin to put additional emphasis on ‘who’ is talking (source) not just what is being said (post). Most companies in the social listening phase have transitioned from free tools to paid platforms.

Companies in the first three stages often suffer from having too much data and not enough insights. They are up to their necks in ‘bigdata’ but lack the experience and expertise to analyze the data and reduce it down to crisp, actionable insights supported by the data. They look for the Insight button on the tools they use but increasingly realize insights are the product of human analysts, not tools or data.

Strategic Listening – The transition to strategic listening brings with it a bias toward ‘listening with a purpose’. I first heard this turn of phrase from my friends at Radian6 and use it often. Listening with a purpose is just that – listening to specific sets of conversations with a specific goal or objective in mind. Often in insight work, the goal or objective may take the form of a hypothesis we are trying to test. Here are a few examples of listening with a purpose:

- Listening for conversations of consumers in a particular phase of the buying decision process

- Listening to customers whose subscriptions or policies are about to expire that are expressing thoughts of changing vendors

- Identifying, tracking and building relationships with key influencers

- Listening for consumer reactions to new packaging or product features

- Mining the emotional content of specific stakeholder groups to determine potential risk around a sensitive issue.

During this phase, an Enterprise listening strategy is often developed and implemented. Some also begin to integrate data from sources beyond social media – search, web analytics and customer data for example.

Social Intelligence – Forrester defines social intelligence as the process of turning social media data into actionable marketing and business strategy. Social intelligence therefore is not about the best times to tweet or whether or not a twitter party would be an effective tactic, it is about informing strategic decisions that impact the company’s success. For me, three concepts are crucial:

- Action – social intelligence is designed to drive true actions.

- Integration – although the definition focuses on social media data and insights, the fact is that true insights often require more than just social data. Integrating data from multiple data sources – consumer survey, behavioral tracking, social posts, search analytics, advertising data, customer records, scan/sales data – allows for greater understanding and richer insights. Integration of multiple data types often requires multiple tools and platforms to aggregate and analyze the data.

- Sharing – For social intelligence to truly take root within an organization, the data and insights should involve cross-disciplinary groups that can look at the data from different perspectives and collectively arrive at better insights than any one group could in a vacuum. The insights then need to be systematically shared broadly across the organization so they may be acted upon in a manner that will create the most impact. Social intelligence can be a catalyst to the silos within an organization tumbling down.

Since the social listening and social intelligence ‘markets’ are relatively immature, this model will continue to evolve and be refined.

Where is your company today on the social media listening maturity model?